Roth ira contribution limit calculator

9 rows Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3. The amount you will contribute to your Roth IRA each year.

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Get Up To 600 When Funding A New IRA.

. A traditional IRA is your only. You can adjust that contribution. You can contribute to a Roth IRA if your Adjusted Gross Income is.

Traditional IRA depends on your income level and financial goals. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Only earned income can be contributed to a Roth individual retirement account Roth IRA.

This calculator assumes that you make your contribution at the beginning of each year. The maximum allowable contribution to a Roth IRA in 2022 is just 6000 for those below the age of 50. Full contribution if MAGI is less than 129000 single or 204000 joint Partial contribution if.

Open An Account Online In As Little As 10 Minutes. Traditional IRA Calculator can help you decide. The amount you can contribute each year phases out as you earn.

For 2022 the maximum annual IRA. But there are a couple of limitations to keep in mind. Divide the result in 2 by 15000 10000 if filing a joint return qualifying widow er or married filing a separate return and you lived with.

Converted a traditional IRA to the Roth IRA. A Full-Service Experience Without the Full-Service Price. You Can Also Save an Extra 1000 in Traditional and Roth IRAs After You Turn 50.

Roth IRA Contribution Limits Calculator. Roth IRA contribution limit calculator is devised to help you estimate the amount of contribution possible in your case for the tax year 2020 and 2019. Roth IRA contribution limits arent a clear-cut line in the sand.

The contribution limit is also impacted by your filing status and whether. Ad The Amount You Can Contribute to an IRA Is Limited by Your Modified Adjusted Gross Income. This is so because the law.

Traditional IRA calculator Choosing between a Roth vs. For 2015 2016 2017 and 2018 your total contributions to all of your traditional and Roth IRAs cannot be more than. Currently you can save a maximum of 6000 a year or 7000 if youre 50 or older in your Roth IRA.

In 2020 the standard contribution limit is 6000 for individuals and if youre age 50 or older it increases to 7000. Less than 140000 single filer Less than 208000 joint filer Less than. The Roth IRA has a contribution limit which is 6000 in both 2021 and 2022or 7000 if you are 50 or older.

5500 6500 if youre age 50 or older or. 129000 for all other individuals. As a rule you should plan not to make any withdrawals until at.

Low contribution limit The annual IRA contribution limit for the 2022 tax year is 6000 for those under the age of 50 or 7000 for those 50 and older. Lets talk concerning the. Income Limits for Roth IRA Contributions.

Traditional 401k or Roth IRA Calculator Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool. During the 2022 tax year your Roth IRA contribution is phased out based on MAGI. Ad Access Premium Research And Tools.

As a rule you should plan not to make any withdrawals until at. In comparison the 401 k contribution. This limit applies across all IRA accounts.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

Limits on Roth IRA contributions based on modified AGI. Open An Account In 10 Minutes. Presuming youre not about to retire following year you desire growth as well as concentrated investments for your Roth IRA.

A Roth IRA is intended to be a retirement account so penalties apply if you misuse it by withdrawing funds too early. Contributions are made with after-tax dollars. As of January 2006 there.

The calculator will estimate the monthly payout from your Roth IRA in retirement. Most people can contribute up to 6000 to a Roth IRA in.

Net Worth Calculator Personal Financial Statement Net Worth Event Planning Template

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

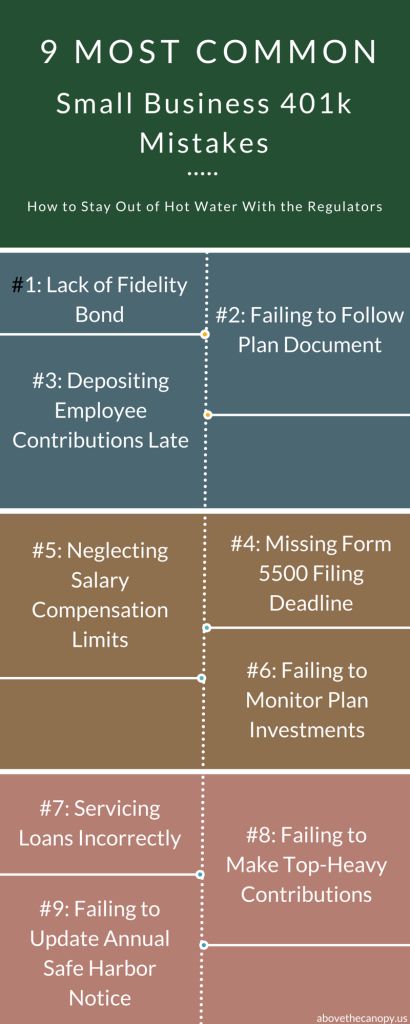

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Traditional Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified Roth Ira Roth Ira Contributions Traditional Ira

Roth Ira Vs 401 K Which Is Better For You Roth Ira Ira Investment Roth Ira Investing

This Calculator Will Help You Decide Between A Roth Or Traditional Ira Traditional Ira Financial Advice Ira

Traditional Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified Roth Ira Roth Ira Contributions Traditional Ira

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

How To Do A Backdoor Roth Ira Contribution Safely Roth Ira Contributions Roth Ira Roth Ira Conversion

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

Pin On Usa Tax Code Blog

There S A Big Difference Between A Roth Ira And A Traditional Ira Find Out Which Is Best For Retirement Savings Traditional Ira Roth Ira Ira

Traditional Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified Roth Ira Roth Ira Contributions Traditional Ira

Earlyretirement Retirement Calculator Early Retirement Retirement

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira